|

Main page > Comments > Top events of the month > Top 10 oil and gas stories in 2010

Top 10 oil and gas stories in 2010

The National Energy Security Fund introduces top-ten events in the oil and gas industry in November 2010 and is ready to comment on them in detail. -

New taxation procedures in the sector New taxation procedures were discussed throughout 2010. The main conclusion that can be made on the basis of the discussions is that the state has finally realized that the situation is very complicated. The year 2010 is the last year of growth in oil production. The situation obviously should be changed but there is no understanding how. The discussions showed that all strategies drafted by the government do not set the trend of fiscal policies, although such documents should stipulate taxation procedures. Our strategies and main decision-makers act independently of each other. Besides, there is no single fundamental document yet. As a result, we were observing chaos throughout the whole year even from the point of view of discussing the philosophy of required changes. Instead of the single fiscal regime general for the whole sector there are exceptions that are allocated all around the sector: exceptions for Vankor, Caspian region, Yamal. We will soon have only exceptions, there will be no common rules and there will be no necessity to talk about the common taxation regime that needs to be changed. So far the taxation saga seems to have the sad end and the next year does not provide us with optimism.

-

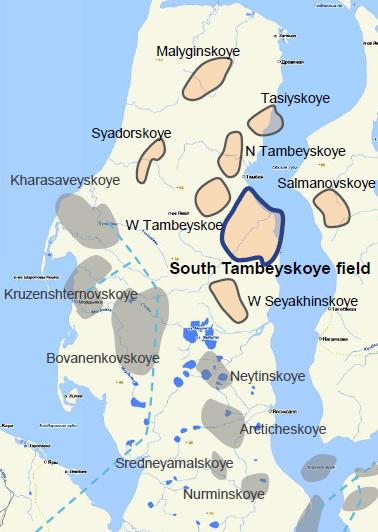

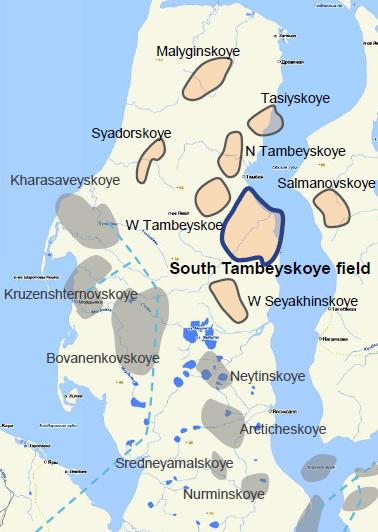

Yamal LNG project development This case was probably the main breaking news of the year. This private project of NOVATEK was personally promoted by Prime Minister Vladimir Putin. There was a special meeting; Putin signed a separate decree of the government on this project. He promised absolutely fantastic taxation preferences, state assistance in creating the infrastructure, and in late 2010 he also promised to transfer licenses of four fields to this project that would enlarge its resource base. Such a surprising attention to only one private project! This just fixes the tendencies NESF mentioned previously. While our expert community was listening to tales about nationalization, NESF was pointing to active privatization unfolding in the interests of “correct players” that, according to our PM, “have been operating in the sector for a long time”. And these players receive quite serious pieces of property and their influence is growing. In this regard, NOVATEK and its main shareholder Gennady Timchenko became the main beneficiaries in 2010. The main question that remained unanswered is whether the state has really realized that the situation is bad and this is why it tries to implement the mega project or this is a mere trick to sell 40% in the project to non-residents and shift the whole burden onto them? We are likely to know the answer to this question in several years.

-

Russian-Ukrainian gas relations Although there was no gas war in 2010, the Ukrainian issue was very important. There were several important events related to this topic in 2010. This was the Kharkov accords that were interpreted by many observers as the “gas for fleet” agreement, Vladimir Putin’s proposal to unite Gazprom and Naftogaz. In the first half of the year there were disputes about gas prices, in the second half there were debates about the fate of the joint venture. A possibility for Gazprom to obtain Ukraine’s gas transportation system was considered. The Kharkov accords were not about exchanging gas for the fleet. Ukraine was proposed a serious discount on gas in exchange for its consent to behave until construction of South Steam is completed. This moment is a key one. In the second half of the year Kiev understood that the South Stream project was feasible, it was not a fairy tale. Having realized that, Ukrainian authorities were panic-stricken, because implementation of South Stream will make Ukraine an absolutely unnecessary state from the point of view of gas transit. By the end of the year Kiev understood that it would have to cede the pipeline system. A joint venture of Naftogaz and Gazprom is likely to be created next year; Gazprom will take control over Ukraine’s gas transportation system – this is inevitable. Then the question whether it is necessary to lay South Stream will arise. NESF does not rule out that Russia may give up South Stream next year.

-

Belarus vs Russia The Belarusian saga began with oil war and ended with a $3.5bn compromise not in favor of Russia. Alexander Lukashenko again demonstrated he knows how to use the transit status of his country and to pressurize Moscow. The question why Belarus does not pay duties on Russian oil is quite logical. The story is really silly: Russian oil crosses the Russian-Belarusian border tax free, Belarus processes this oil and the oil products received go to Europe, while revenues are accumulated in the Belarusian budget. At first the Belarusian president agreed to an agreement stipulating that Belarus would get 6.5m tons of oil tax-free, the oil exceeding this amount would be taxed. When these 6.5m tons were used up, Mr. Lukashenko started buying oil in Venezuela convincing everybody it was economically profitable, although the Belarusian statistics service showed the losses were at least some $60 to $80 per ton. In the end a compromising decision was made: oil crosses the border tax-free but part of revenues from its processing is transferred to the Russian budget. The attitude towards this agreement is not unambiguous. On one side, Russia used to get nothing but now it is to receive some revenues. But on the other side, our position towards the Belarusian partner could have been tougher. He was making rather unpleasant statements on Russia. Now, following the Belarusian presidential elections Lukashenko is completely alone: Europe has brought in its final verdict calling him the last dictator in Europe. In this regard Lukashenko’s speculations about his intention to lean to Europe have finally failed. But there is a question: why Russia having in fact driven Lukashenko into corner and being able to finally defeat him has not finally settled the issue of gas prices? We are entering the year 2011 somewhat up in the air. Definitely there will be no cutoff of supplies but the question remains and the Belarusian economy is still subsidized by cheap Russian hydrocarbons.

-

Accident in the Gulf of Mexico This seems to be far away from Russia but the echo of this catastrophe definitely reached us. The results of the story are quite simple. Despite cunning statements that there is much oil and gas in the world, it is obvious that easily extractable oil is running out. The beginning of large-scale production in Iraq does not change the situation. The depth of the well where the accident took place is 1.5km. This is a fantastic depth that for the Russian oil and gas sector is to a great extent inaccessible. But why? It absolutely clear that if BP could produce cheap oil, it would have never started drilling such wells on the seabed at the depth of 1.5km. And this is not a record deep well. The company has to use advanced technological solutions and risk seriously. And this is the second very important issue on the background of whining about technical backwardness of the oil and gas sector. This is the example of complicated solutions implemented and risks they pose. So, the natural question is how these risks will be hedged in the near future. For Russia this is a very serious issue, because the domestic oil and gas industry unfortunately always lags behind the world oil and gas industry. While offshore production is sharply rising in the world, Russia is only beginning to develop offshore deposits. So far we have nothing to boast about except large Sakhalin projects and Caspian projects. However, if the Shtokman project begins next year, this will be sizable contribution to shelf development.

-

Qatar decides not to make investment decisions on building new LNG plants until 2014 This is an important decision for Russia, because talks about cheap Qatari gas have already become common. This gas allegedly should force Russian gas out of the European market. NESF long ago said Qatar would not be able to develop LNG production at such a pace. But there were popular forecasts that Qatar would export 200bn cu m of gas by 2012. Even serious European experts believed these tales pointing out that the production cost of Qatari gas was $90 per 1,000 cu m and Qatar would be eagerly developing production of gas selling it at $110 with a $20 profit margin. But in 2009 and 2010 Qatar had to sell large amounts of gas on the European market because it had expected to sell it in the USA but the latter refused to buy this gas following its shale gas revolution. Since the conditions of project financing included the provision on obligatory sale of gas, Qatar had to sell the gas at low prices. But in the future Qatar is not going to sell its resources at laughable prices resulting in comfortable conditions for Europe and competition with Russia. In this regard, cooperation of Russia and Qatar may continue in 2011. By the way, it is interesting that FIFA World Cups in 2018 and 2022 will be held in Russia and Qatar respectively. So, natural gas kind of rules the world.

-

Gas talks with Poland This story could have been titled broader, e.g. “Russian-European Gas Relations”. But the Polish story has everything that is characteristic of our relations with Europe in general. The Polish expert “choir” was singing a song about Poland not requiring Russian gas because Warsaw would soon build an LNG terminal in Swinoujscie, launch shale gas production and would buy gas from Norway. Russian experts also contributed. For instance, some democratic newspaper posted an article saying that Gazprom was giving bribes in Poland because allegedly only weak-minded people could sign a contract on expanding Russian gas purchases under the condition when there would be more than enough of non-Russian gas. As a result, it turned out Warsaw would not have enough of non-Russian gas because Norway does not have the volume of gas sufficient for Poland and the shale gas production was a fiction as there are no such projects in Poland. So, Warsaw had to increase the volume of gas supplies from Russia within the existing contract. Yet, it did not prolong the contract. Nevertheless, the story is very indicative. The EU tried to apply the Third Energy Package in Poland as the Yamal-Europe pipeline runs across Poland and its Polish section is 50% owned by Gazprom. But the application of the Third Energy Package failed, instead the Second Package was applied. However, it is not ruled out that the issue will be raised again in 2011 and the Third Energy Package will be enforced.

-

ConocoPhillips sells LUKOIL shares, E.ON sells Gazprom shares These cases demonstrate dissatisfaction of foreign investors about cooperation with Russian companies. This is a serious problem. On one side, the state realizes that we need nonresidents. On the other side, we create rather complicated conditions of work for them. Over the past few years there were talks about the necessity to liberalize access of nonresident but no liberalization has occurred. The state should certainly learn some lessons from the situation. Unfortunately, the vertical works slowly. There was a clear signal from Vladimir Putin what to do. The signal was heard but the ministry does not understand what to do and whether liberalization should have a limit. The ministry may be reprimanded for doing either too much or too little. This is why the case is swept under the carpet, nothing is going on and investors have started leaving. Our oil and gas industry cannot develop without money, technologies and sale markets. It is simply impossible to lock ourselves inside the country.

-

Sergey Bogdanchikov dismissed This was the biggest change in the Russian oil and gas industry. The replacement had been expected this is why it was not sensational. This dismissal fixed the division of the zones of influence in our oil and gas industry by major clans. Rosneft has remained under control of deputy PM Igor Sechin. Bogdanchikov, who had suddenly decided he was the chief, suffered much from his forgetfulness.

-

Trebs and Titov deposits find owner The state finally finished almost a five year long saga of handing over two deposits in the Komi Republic. They were promised to be sold long ago and finally they were given to Bashneft, a private oil company that had been purchased by Sistema before that. All the other bidders, including the state company Rosneft, were disqualified. This story confirms the tendency, according to which Putin and clans around him stake on privatization. Although there are no complete guarantees, as the case of Mikhail Khodorkovsky shows, but other private owners feel quite comfortable. For instance, Mr. Abramovich sold Sibneft and got cash. Russian shareholders have half in TNK-BP and nothing is happening to them. So, the state is stuffing with assets not only Gazprom and Rosneft. Moreover, by the way Rosneft is readying to become a private company.

|

Special report:Nord Stream 2 and Ukraine: Costs Should DecideShale Revolution: Myths and RealitiesLiquefied Natural Gas Outlook: Expectations and RealityOil and Gas Sector Regulation and Interim Results in 2024. Outlook for 2025Northern Logistics Route: Should One Expect a Breakthrough?Current Status of Russian Oil ExportsGreen and Climate Agenda: Reset AttemptGovernment 2024: New Configuration of RegulatorsAll reports for: 2015 , 14 , 13 , 12 , 11 , 10 , 09 , 08 , 07 |

There has been much discussion about how Russia – Europe’s biggest gas supplier – can continue to supply gas to Europe over the coming decades in the most secure and cost efficient way. Gazprom and its European partners have decided that building two additional pipelines through the Baltic Sea (Nord Stream 2) is the best commercial solution to secure future gas supplies for the EU, where gas production continues to decline and demand is expected to grow.

There has been much discussion about how Russia – Europe’s biggest gas supplier – can continue to supply gas to Europe over the coming decades in the most secure and cost efficient way. Gazprom and its European partners have decided that building two additional pipelines through the Baltic Sea (Nord Stream 2) is the best commercial solution to secure future gas supplies for the EU, where gas production continues to decline and demand is expected to grow. The boom in shale gas production in the US and its wide-ranging influence on markets rocked the gas world. Liquefied gas deliveries were redirected, altering the already fragile balance of demand and supply in traditional markets for pipeline gas in Europe.

The boom in shale gas production in the US and its wide-ranging influence on markets rocked the gas world. Liquefied gas deliveries were redirected, altering the already fragile balance of demand and supply in traditional markets for pipeline gas in Europe. World market has shown interest to liquefied gas. Russia has so far been aside of it. However, producers have announced several large LNG projects. The new study will help investigate this delicate subject and understand what is in store for LNG production and export in the nearest years.

World market has shown interest to liquefied gas. Russia has so far been aside of it. However, producers have announced several large LNG projects. The new study will help investigate this delicate subject and understand what is in store for LNG production and export in the nearest years. A new government was formed in Russia in spring 2024. Sergey Tsivilyov became Energy Minister. The first six months of the new government’s regulation of the fuel and energy sector are already past, which enables drawing the first analytical conclusions. Therefore, interim production results for 2024 have a special place in this research. We analyse the past year in two papers at once, as has become a tradition already. The gas industry is considered in a separate report. Meanwhile, we focus on oil here. The report’s special value lies in the data of our own oil export estimation model.

A new government was formed in Russia in spring 2024. Sergey Tsivilyov became Energy Minister. The first six months of the new government’s regulation of the fuel and energy sector are already past, which enables drawing the first analytical conclusions. Therefore, interim production results for 2024 have a special place in this research. We analyse the past year in two papers at once, as has become a tradition already. The gas industry is considered in a separate report. Meanwhile, we focus on oil here. The report’s special value lies in the data of our own oil export estimation model. The Northern Sea Route and the Arctic in general were made a state priority even before the conflict in Ukraine. The key question is: can nice talk about the NSR as a profitable and strategic route and about Russia’s return to the Arctic be converted into actual breakthroughs making it possible to carry out at least the executive’s own plans? The strategic content concerning the NSR is relatively new, but many problems are old.

The Northern Sea Route and the Arctic in general were made a state priority even before the conflict in Ukraine. The key question is: can nice talk about the NSR as a profitable and strategic route and about Russia’s return to the Arctic be converted into actual breakthroughs making it possible to carry out at least the executive’s own plans? The strategic content concerning the NSR is relatively new, but many problems are old. Getting over the 2022-2024 sanctions is the most important test for the Russian oil industry. After the US, United Kingdom, EU, and G7 introduced a ban on buying Russian oil and petroleum products (with some exceptions) and the price cap mechanism, Russia managed to find alternative sale options in countries that are now commonly called the “Global South”. However, it is important to consider exports in detail. This is what we do in the new NESF report.

Getting over the 2022-2024 sanctions is the most important test for the Russian oil industry. After the US, United Kingdom, EU, and G7 introduced a ban on buying Russian oil and petroleum products (with some exceptions) and the price cap mechanism, Russia managed to find alternative sale options in countries that are now commonly called the “Global South”. However, it is important to consider exports in detail. This is what we do in the new NESF report. In spite of dramatic worsening of relations with the West, the subject of climate has not vanished from Russian economic plans. Environmental issues have even topped the list of declared problems.

In spite of dramatic worsening of relations with the West, the subject of climate has not vanished from Russian economic plans. Environmental issues have even topped the list of declared problems. While the result of the presidential election in Russia was absolutely predictable, further moves forming new government agencies were more intriguing. Eventually, on the one hand, it would seem that Putin chose to avoid radical decisions on the civilian part of the Cabinet. Prime Minister Mishustin kept his post and almost all deputy prime ministers did. On the other, there are still meaningful changes. First of all, the Ministry of Energy got a new head. This alone deserves special attention.

While the result of the presidential election in Russia was absolutely predictable, further moves forming new government agencies were more intriguing. Eventually, on the one hand, it would seem that Putin chose to avoid radical decisions on the civilian part of the Cabinet. Prime Minister Mishustin kept his post and almost all deputy prime ministers did. On the other, there are still meaningful changes. First of all, the Ministry of Energy got a new head. This alone deserves special attention.